Staff Report #1

April 24, 2024

To All Commissioners

Re: Bus Replacement – Contract Award

Recommendations

That the Commission:

- ACCEPT the bid submission from New Flyer Industries Canada, ULC for the supply of both 40’ and 60’ replacement and expansion buses for the period of 2024 through 2027, at a unit cost of $857,250.00 and $1,309,832.00 exclusive of applicable taxes respectively for buses ordered in 2024 (price escalation will apply going forward);

- DIRECT the administration finalize the appropriate contract with New Flyer Industries Canada, ULC;

- DIRECT administration to confirm the ability to adjust future year capital budget requirements to accommodate for the inflationary impacts above which was budgeted for; and

- APPROVE the purchase of the 2024 replacement bus requirements (15 – 40’ buses & 2 – 60’ buses) at a total cost of $15,478,414, exclusive of applicable taxes and the 2025 replacement bus requirements (15 – 40’ buses & 2- 60’ buses) at a total cost of $15,478,414

Background

The issuance of a request for tender for the purchase of buses is required both as a good business practice, but also in order to qualify purchases which are funded in whole or in part by the Provincial and Federal governments. As the extension period of the previous contract for bus purchase had expired, a request for proposal was issued and processed in accordance with established procedures.

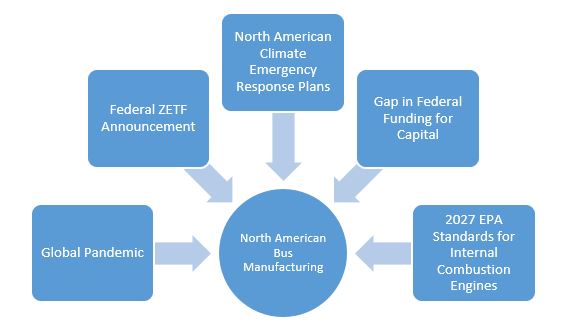

Subsequent to the issuance of the last contract for bus procurement, the North-American bus manufacturing sector has experienced pressures resulting from external program and policy decisions as well as the global pandemic. Each of these external pressures is discussed in greater detail below.

Global Pandemic

In April 2020, the World Health Organization declared a global pandemic which resulted in major disruptions world-wide. The bus manufacturing sector in North America, like many other sectors, was significantly impacted, primarily as the result of material supply chain and labour issues. Early on in the pandemic, productions were impacted by public health mandates, in many cases resulting in plant shutdowns for extended periods of time. In addition, the pandemic-related employee non-attendance resulted in difficulties maintaining production schedules. As time progressed, public health measures were loosened and employee attendance improved, however supply chain issues for the component parts required to build a bus began to materialize. These issues resulted in significant price escalations in many cases, and a significant production delay specific to the micro-chip shortage, resulting in buses being parked until such time as the chips could be installed.

These issues placed significant pressure on the financial sustainability of bus manufactures as the full cost of building these buses had been expended with the exception of the required missing components, but contracts were structured to provide payment upon delivery. This financial pressure was compounded when municipalities placed their capital projects on hold during the pandemic as they directed all efforts at maintaining operations albeit at much lower levels of service. This resulted in a dip in the order forecasts, further impacting productivity going forward.

Federal Zero Emission Transit Fund (ZETF)

In August 2021, the Canadian Federal government announced the Zero Emission Transit Fund (ZETF), which included $2.75 billion in funding over five years to support public transit and school bus operators’ plans for electrification by supporting the purchase of zero-emission buses (ZEBs) and build supporting infrastructure. The funding program was application-based, requiring municipalities to submit a business case including the full costing of the program as well as a feasibility study specific to the transit system identifying the cost/benefit analysis of a full fleet transition to zero-emission technology.

The announcement of this funding program prompted many municipalities to re-visit their plans to begin fleet transition given the funding shortfalls between the cost of a diesel bus and a zero-emission bus would be covered under this program. As a result, bus manufactures in Canada experienced growth in orders for zero-emission buses and a corresponding decline in diesel bus orders, which, while anticipated, occurred at a more rapid rate than previously expected.

North American Climate Emergency Response Plans

Notwithstanding the ongoing global pandemic, jurisdictions across North America continued to move forward with the establishment of Climate Emergency Response Plans in an effort to curb their local carbon footprints. Given that public transit buses make up a significant portion of many municipal fleets, coupled with the announcement of the Zero Emission Transit Fund in Canada (and similar funding at the State level in the USA), many jurisdictions established target dates for full fleet transitions, and in some cases, committed to the exclusion of diesel bus purchases going forward. These plans resulted in even more disruptions to production forecasts, which had not anticipated the shift away from diesel buses to occur so quickly.

Gap in Federal Funding

Supply chain disruptions and extended timelines associated with Federal funding application approvals resulted in delays with respect to the actual procurement of buses in many jurisdictions. In addition, significant infrastructure is required to be in place prior to the utilization of battery electric buses, often requiring facility retrofits. While some transit systems, who were further along the fleet transition continuum have agreements in place, many are still waiting approval or are at the expression of interest stage of the process for the ZETF program.

In early 2024, the Canadian Federal government announced that all approved funding under the ZETF must be fully expended by December 31, 2025. Given current delivery schedules for ZEBs, this date is resulting in concerns for many that the funding will be lost, leaving significant funding gaps to be addressed should the fleet transition plans continue.

The Federal government has pointed to the upcoming Permanent Transit Fund (PTF), which is scheduled to begin in 2026 as a source of funding that can be utilized going forward in part to cover the costs associated with fleet transition. While this funding source is welcome news, the funding gap for jurisdictions who are just now looking to begin their fleet transition means that orders for these new buses may have to be delayed until 2026 once funding allocations have been confirmed. The details with respect to the PTF program that have been released indicate that a significant portion of the funding will be dedicated to regional transit plans with direct ties to affordable housing and the role transit can play in helping alleviate these issues. Addressing this issue, which in many cases will require growth in transit services will place a significant strain on the available funding that will also be looked toward to help address the incremental costs of fleet transition.

Similar concerns are being identified in the US with the impending election, noting a change in leadership could result in a reverse course on climate emergency directives and supporting funding.

Bus manufacturers are being forced to make decisions with respect to future product offerings while a number of external events have the potential to significantly impact demand going forward.

2027 EPA Standards for Internal Combustion Engines

The US Environmental Protection Agency (EPA) creates standards that are followed by bus manufacturers in North America given their customer base covers both countries. Each time the EPA standards for diesel engines are updated, engine manufacturers must adapt their technologies to ensure compliance. Engines for the two bus manufacturers supplying Canada are provided by Cummins Inc, who have confirmed they will have a 2027 EPA-complaint engine (X-10 Transit) available to North American bus manufacturers sometime in 2026, for install in buses going forward. While this is welcome news, bus manufacturers have been faced with the decision of whether to invest the required engineering hours to integrate this new engine into their chassis noting the forecasted decline of diesel bus orders going forward. This further complicates the landscape for transit providers noting that at some point in the future diesel will no longer be an option that is available and many smaller transit systems are not equipped to begin the transition to zero-emission technology given resource issues.

Impacts on the Canadian Transit Sector

The culmination of the aforementioned impacts on the bus manufacturing sector has resulted in significant concern for transit providers in Canada with respect to availability, options and pricing of transit buses going forward. The Canadian Urban Transit Association (CUTA) undertook to meet with the three primary players in bus manufacturing in Canada (New Flyer Inc., Nova Bus and Cummins Inc.) in an effort to gain a better understanding of their plans going forward and share this information with transit systems. On April 11, 2024, CUTA held a session in which representatives from each of the aforementioned parties provided commentary with respect to their future plans, in summary:

- Cummins Inc. indicated their plans to have an X-10 Transit diesel engine available some time in 2026 which will meet 2027 EPA standards for diesel engines. They are also working on new CNG and Hybrid engines which are scheduled to be available in 2027;

- New Flyer Inc. and Nova Bus indicated their plans to have the following options available going forward:

| Bus Platform | New Flyer Availability | Nova Bus Availability |

| Diesel 40’ and 60’ | · Currently with L9 engine

· Post 2026 with X10 engine |

· Currently with L9 engine for orders already submitted.

· Production on diesel buses will cease December 2025. |

| CNG 40’ and 60’ | · Currently with L9N engine

· Post 2026 with X10 engine to be determined based on demand assessment |

· Production on CNG buses will cease December 2026. |

| Hybrid 40’ | · Currently L9 with B6.9 electric motor

· Going forward to be determined based on demand assessment |

· Phased out at the end of 2024

· New option may be available in 2027 based on demand assessment |

| Hybrid 60’ | · Currently not available

· No options for new engine |

· Currently not available |

In summary, the information in the table indicates that there is only one manufacturers in Canada that will supply diesel buses going forward. New Flyer has indicated they plan to have a diesel bus available until at least 2030, noting demand for the product will drive decisions going forward. This situation is not ideal as all pressure for diesel buses (which will be again upgraded to become cleaner in 2026) will be placed on one supplier, who will also be balancing this demand with demand for other platforms within their portfolio. Further pressure is also anticipated given the decision by Nova Bus to withdraw from the US market in 2025. As indicated earlier, both New Flyer and Nova Bus had traditionally participated in the North American bus market, providing product to transit systems in both countries.

Transit systems and bus manufacturers have committed to working together in an effort to address all of the aforementioned issues, in order to ensure that transit bus manufacturing continues to be financially viable going forward. CUTA will be closely following the actions taken by the American Public Transit Association to address these issues and working with all parties to determine which may be practical for implementation in Canada. Options moving forward include:

- transit systems working together to spec a bus that is consistent across numerous transit properties (alieving some pressure on manufacturers to stock multiple options);

- local jurisdictions considering progress payments as part of future bus contracts in order to alleviate pressure on manufacturers carrying costs during the bus build process; and

- removal of cost-prohibitive clauses in future bus contracts including but not limited to indemnification clauses, insurance requirements and liquidated damage clauses

Impacts on LTC Request for Proposal

As previously indicated, the request for proposal for the supply of 40’ and 60’ diesel buses for the period of 2024-2027 was issued and processed in accordance with established procedures. One bid was received from New Flyer Inc., the details of which are set out in the table below, noting the pricing provided is inclusive of all options and exclusive of applicable taxes.

| Bidder | 40’ Bus | 60’ Bus |

| New Flyer Industries Canada, ULC | $ 857,250.00 | $1,309,832.00 |

These prices represent an approximate 7% increase over 2023 pricing for a 40’ diesel bus and an approximate 8% increase over 2023 pricing for a 60’ diesel bus. These costs are slightly higher than those included in the approved 2024 capital budget program. The table below sets out the impacts of the pricing on the 2024 bus replacement program.

2024 Bus Replacement Program

| Description | Units | 2024 Budget Amount | Amended Cost | Variance |

| Bus Replacement (40’) | 15 | $ 12,015,000 | $ 13,084,500 | $ 1,069,500 |

| Bus Replacement (60’) | 2 | 2,425,600 | 2,665,800 | 240,200 |

| Ancillary Equipment | 477,700 | 477,700 | – | |

| 17 | $ 14,918,300 | $ 16,228,000 | $ 1,309,700 | |

| Funding | ||||

| City of London | $ 10,918,300 | $ 12,228,000 | $ 1,309,700 | |

| Federal Gas Tax – C/L | 4,000,000 | 4,000,000 | – | |

| Total | $ 14,918,300 | $ 16,228,000 | $ 1,309,700 |

The delivery time provided in the bid document indicated third quarter 2025 (approximately 16 month delivery). This represents a significant issue as the assumption with the bus replacement program is that 17 buses would be replaced in 2024, followed by another 17 in 2025. Given these extended timelines, additional operating expenditures are likely to occur as buses will need to be maintained for a year beyond what was planned in order to continue to meet service demands.

Given these extended timelines, and as set out in part iv) of the report recommendation, administration is recommending that an order be placed for both the 2024 and 2025 replacement buses. Receipt of the majority of these buses in 2025 will get the bus replacement schedule back on track. Given the capital budget relating to replacement buses has been approved for all four years as part of the multi-year budget process, there is no concern with proceeding in this manner. In addition, ordering both years’ replacement buses at this time will protect the 2025 program from future inflation as they will be ordered at the current pricing.

As part iii) of the report recommendation sets out, administration is working with civic administration to confirm the opportunity to adjust this budget given expenditures will not occur until late 2025. Should there be no ability to adjust the 2024 program budget, the number of buses on the 2024 order will be reduced to meet available budget and the number in 2025 will be increased to include those not purchased in the 2024 order. This increase, along with the associated price increase will be forwarded to council as part of the annual budget update for 2025.

Updates with respect to the bus replacement program will be provided as warranted through the monthly financial reporting updates and/or quarterly work plan updates.

Recommended by:

Craig Morneau, Director of Fleet and Facilities

Mike Gregor, Director of Finance

Concurred in by:

Kelly S. Paleczny, General Manager